Nos nouvelles publications pour rester à jour dans tous les domaines

-

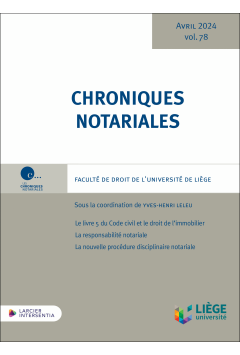

Chroniques notariales - Volume 78Livre | 1ère édition 2024 | Belgique | Yves-Henri Leleu230,00 € TTCEn stock expédié endéans les 2 jours ouvrables

Chroniques notariales - Volume 78Livre | 1ère édition 2024 | Belgique | Yves-Henri Leleu230,00 € TTCEn stock expédié endéans les 2 jours ouvrables -

La réforme des Finances publiques et de l'Administration en RDCEnjeux d'un État moderne et performantLivre | 1ère édition 2024 | Monde | Doudou Roussel Fwamba Likunde Li-Botayi80,00 € TTCEn stock expédié endéans les 2 jours ouvrables

La réforme des Finances publiques et de l'Administration en RDCEnjeux d'un État moderne et performantLivre | 1ère édition 2024 | Monde | Doudou Roussel Fwamba Likunde Li-Botayi80,00 € TTCEn stock expédié endéans les 2 jours ouvrables -

Code essentiel - Code de droit électoral 2024Élections européennes, fédérales, régionales, provinciales et communalesCode | 1ère édition 2024 | Belgique | Frédéric Bouhon, Min Reuchamps30,00 € TTCEn stock expédié endéans les 2 jours ouvrables

Code essentiel - Code de droit électoral 2024Élections européennes, fédérales, régionales, provinciales et communalesCode | 1ère édition 2024 | Belgique | Frédéric Bouhon, Min Reuchamps30,00 € TTCEn stock expédié endéans les 2 jours ouvrables -

Un nouveau droit international écologiqueHabiter autrement la TerreLivre | 1ère édition 2024 | Monde | Emmanuelle Tourme Jouannet45,00 € TTCEn stock expédié endéans les 2 jours ouvrables

Un nouveau droit international écologiqueHabiter autrement la TerreLivre | 1ère édition 2024 | Monde | Emmanuelle Tourme Jouannet45,00 € TTCEn stock expédié endéans les 2 jours ouvrables -

Annales du droit luxembourgeois. Volume 32 - 2022Livre | 1ère édition 2024 | Luxembourg | Alex Engel, Steve Jacoby, Dean Spielmann, Marc Thewes105,00 € TTCEn stock expédié endéans les 2 jours ouvrables

Annales du droit luxembourgeois. Volume 32 - 2022Livre | 1ère édition 2024 | Luxembourg | Alex Engel, Steve Jacoby, Dean Spielmann, Marc Thewes105,00 € TTCEn stock expédié endéans les 2 jours ouvrables -

L’identité numérique en constructionQuels enjeux et quels modèles ?Livre | 1ère édition 2024 | Europe | Jessica Eynard, Giorgia Macilotti95,00 € TTCEn stock expédié endéans les 2 jours ouvrables

L’identité numérique en constructionQuels enjeux et quels modèles ?Livre | 1ère édition 2024 | Europe | Jessica Eynard, Giorgia Macilotti95,00 € TTCEn stock expédié endéans les 2 jours ouvrables -

Actualités en droit pénal des affairesLivre | 1ère édition 2024 | Belgique | Maximilien Arnoldy, Mona Giacometti, Aurélie Verheylesonne60,00 € TTCEn stock expédié endéans les 2 jours ouvrables

Actualités en droit pénal des affairesLivre | 1ère édition 2024 | Belgique | Maximilien Arnoldy, Mona Giacometti, Aurélie Verheylesonne60,00 € TTCEn stock expédié endéans les 2 jours ouvrables -

Les coopératives d'habitantsConditions de possibilité juridiques d’une formule innovante d’habitatLivre | 1ère édition 2024 | Belgique | Nicolas Bernard, Isabelle Verhaegen60,00 € TTCEn stock expédié endéans les 2 jours ouvrables

Les coopératives d'habitantsConditions de possibilité juridiques d’une formule innovante d’habitatLivre | 1ère édition 2024 | Belgique | Nicolas Bernard, Isabelle Verhaegen60,00 € TTCEn stock expédié endéans les 2 jours ouvrables -

Défédéraliser la justice ?Une étude de droit comparé juridico-politiqueLivre | 1ère édition 2024 | Belgique | Arvid Rochtus, Stefan Sottiaux125,00 € TTCEn stock expédié endéans les 2 jours ouvrables

Défédéraliser la justice ?Une étude de droit comparé juridico-politiqueLivre | 1ère édition 2024 | Belgique | Arvid Rochtus, Stefan Sottiaux125,00 € TTCEn stock expédié endéans les 2 jours ouvrables -

Annuaire congolais de droit international2023Livre | 1ère édition 2024 | Monde | Sayeman Bula Bula100,00 € TTCEn stock expédié endéans les 2 jours ouvrables

Annuaire congolais de droit international2023Livre | 1ère édition 2024 | Monde | Sayeman Bula Bula100,00 € TTCEn stock expédié endéans les 2 jours ouvrables -

Droit constitutionnel de la RoumanieLivre | 1ère édition 2024 | Europe | Elena-Simina Tanasescu80,00 € TTCEn stock expédié endéans les 2 jours ouvrables

Droit constitutionnel de la RoumanieLivre | 1ère édition 2024 | Europe | Elena-Simina Tanasescu80,00 € TTCEn stock expédié endéans les 2 jours ouvrables -

Les responsabilités et les garanties du vendeur en droit belge et en droit françaisApproche de droit comparéLivre | 1ère édition 2024 | Belgique, France | Bernard Dubuisson, Patrice Jourdain175,00 € TTCEn stock expédié endéans les 2 jours ouvrables

Les responsabilités et les garanties du vendeur en droit belge et en droit françaisApproche de droit comparéLivre | 1ère édition 2024 | Belgique, France | Bernard Dubuisson, Patrice Jourdain175,00 € TTCEn stock expédié endéans les 2 jours ouvrables -

Les prix de transfertLivre | 3e édition 2024 | Belgique | Thierry Vanwelkenhuyzen, Alexis De Méyère130,00 € TTCPrix étudiant: 60,00 €En stock expédié endéans les 2 jours ouvrables

Les prix de transfertLivre | 3e édition 2024 | Belgique | Thierry Vanwelkenhuyzen, Alexis De Méyère130,00 € TTCPrix étudiant: 60,00 €En stock expédié endéans les 2 jours ouvrables -

Code essentiel - Droit administratif 2024À jour au 15 décembre 2023Code | 15e édition 2024 | Belgique | David Renders95,00 € TTCPrix étudiant: 42,00 €En stock expédié endéans les 2 jours ouvrables

Code essentiel - Droit administratif 2024À jour au 15 décembre 2023Code | 15e édition 2024 | Belgique | David Renders95,00 € TTCPrix étudiant: 42,00 €En stock expédié endéans les 2 jours ouvrables -

Droit administratifLivre | 1ère édition 2024 | Belgique | Michel Pâques165,00 € TTCPrix étudiant: 60,00 €En stock expédié endéans les 2 jours ouvrables

Droit administratifLivre | 1ère édition 2024 | Belgique | Michel Pâques165,00 € TTCPrix étudiant: 60,00 €En stock expédié endéans les 2 jours ouvrables -

Délibérer au ParlementLe droit parlementaire, instrument du renouveau de la démocratie représentative ?Livre | 1ère édition 2024 | Belgique | Julian Clarenne150,00 € TTCEn stock expédié endéans les 2 jours ouvrables

Délibérer au ParlementLe droit parlementaire, instrument du renouveau de la démocratie représentative ?Livre | 1ère édition 2024 | Belgique | Julian Clarenne150,00 € TTCEn stock expédié endéans les 2 jours ouvrables -

L'avenir de la justice pénale internationaleLivre | 2e édition 2024 | Monde | Jean Albert52,00 € TTCEn stock expédié endéans les 2 jours ouvrables

L'avenir de la justice pénale internationaleLivre | 2e édition 2024 | Monde | Jean Albert52,00 € TTCEn stock expédié endéans les 2 jours ouvrables -

Concilier santé et droits fondamentaux en période de pandémieUne analyse juridique des expériences de la France et du JaponLivre | 1ère édition 2024 | Monde | Guillaume Rousset, Philippe Pédrot, Tetsu Isobe, Haluna Kawashima90,00 € TTCEn stock expédié endéans les 2 jours ouvrables

Concilier santé et droits fondamentaux en période de pandémieUne analyse juridique des expériences de la France et du JaponLivre | 1ère édition 2024 | Monde | Guillaume Rousset, Philippe Pédrot, Tetsu Isobe, Haluna Kawashima90,00 € TTCEn stock expédié endéans les 2 jours ouvrables -

Code annoté - Droit familial 2024À jour au 1er janvier 2024Code | 15e édition 2024 | Belgique | Jean-Louis Renchon, Vinciane Rosenau140,00 € TTCPrix étudiant: 50,00 €En stock expédié endéans les 2 jours ouvrables

Code annoté - Droit familial 2024À jour au 1er janvier 2024Code | 15e édition 2024 | Belgique | Jean-Louis Renchon, Vinciane Rosenau140,00 € TTCPrix étudiant: 50,00 €En stock expédié endéans les 2 jours ouvrables -

La transmission genrée du capital familialÉtude juridique et empirique pour l'Institut pour l'égalité des femmes et des hommesLivre | 1ère édition 2024 | Belgique, France | Yves-Henri Leleu, Elisabeth Alofs, Chloé Harmel, Michel Peters60,00 € TTCEn stock expédié endéans les 2 jours ouvrables

La transmission genrée du capital familialÉtude juridique et empirique pour l'Institut pour l'égalité des femmes et des hommesLivre | 1ère édition 2024 | Belgique, France | Yves-Henri Leleu, Elisabeth Alofs, Chloé Harmel, Michel Peters60,00 € TTCEn stock expédié endéans les 2 jours ouvrables

Nos formations pour enrichir vos connaissances

-

Le juge à sa juste place en matière d’environnement et de climat ?Conférence de sortie de l’ouvrage Les grands arrêts inspirants du droit de l’environnementFormation | Mercredi 29 mai 2024 | Belgique | Marie-Sophie de Clippele, Delphine Misonne

Le juge à sa juste place en matière d’environnement et de climat ?Conférence de sortie de l’ouvrage Les grands arrêts inspirants du droit de l’environnementFormation | Mercredi 29 mai 2024 | Belgique | Marie-Sophie de Clippele, Delphine Misonne -

Webinaire – Réforme de la responsabilité extracontractuelle : focus sur trois grandes nouveautés du livre 6Colloque | Mardi 11 juin 2024 | Belgique | Marine Boreque, Céline Hélas, Raphaëlle Deutsch

Webinaire – Réforme de la responsabilité extracontractuelle : focus sur trois grandes nouveautés du livre 6Colloque | Mardi 11 juin 2024 | Belgique | Marine Boreque, Céline Hélas, Raphaëlle Deutsch -

Intelligence artificielle et services financiersColloque anniversaire de la Revue internationale des services financiersColloque | Jeudi 13 juin 2024 | France

Intelligence artificielle et services financiersColloque anniversaire de la Revue internationale des services financiersColloque | Jeudi 13 juin 2024 | France -

Webinaire – Rédiger des avis juridiques créateurs de valeurWebinaire | Jeudi 19 septembre 2024 | Belgique | Antoine Henry de Frahan

Webinaire – Rédiger des avis juridiques créateurs de valeurWebinaire | Jeudi 19 septembre 2024 | Belgique | Antoine Henry de Frahan -

Webinaire – Gestion du risque pour les juristesWebinaire | Lundi 7 octobre 2024 | Belgique | Antoine Henry de Frahan

Webinaire – Gestion du risque pour les juristesWebinaire | Lundi 7 octobre 2024 | Belgique | Antoine Henry de Frahan -

Colloque – La régularisation urbanistique : évolutions, aspects pratiques et incidences sur les contratsColloque | Jeudi 6 juin 2024 | Belgique | Lauriane Olivier, Joël van Ypersele

Colloque – La régularisation urbanistique : évolutions, aspects pratiques et incidences sur les contratsColloque | Jeudi 6 juin 2024 | Belgique | Lauriane Olivier, Joël van Ypersele -

Webinaire – La déduction des surcoûts d'empruntWebinaire | Lundi 2 septembre 2024 | Belgique | Geoffroy Galéa, Cassandre Guéry

Webinaire – La déduction des surcoûts d'empruntWebinaire | Lundi 2 septembre 2024 | Belgique | Geoffroy Galéa, Cassandre Guéry -

Formation – Survival Kit des juristes pour comprendre les éléments des états financiers d’une sociétéFormation | Jeudi 13 juin 2024 | Belgique | Olivier Fondeur

Formation – Survival Kit des juristes pour comprendre les éléments des états financiers d’une sociétéFormation | Jeudi 13 juin 2024 | Belgique | Olivier Fondeur -

Webinaire de mise à jour ISOC – printemps 2024Webinaire | Lundi 13 mai 2024 | Belgique | Laura Dewez, Fabrice Grognard

Webinaire de mise à jour ISOC – printemps 2024Webinaire | Lundi 13 mai 2024 | Belgique | Laura Dewez, Fabrice Grognard -

Webinaire de mise à jour TVA – printemps 2024Webinaire | Lundi 27 mai 2024 | Belgique | Yves Bernaerts

Webinaire de mise à jour TVA – printemps 2024Webinaire | Lundi 27 mai 2024 | Belgique | Yves Bernaerts -

Webinaire de mise à jour IPP – printemps 2024Webinaire | Jeudi 18 avril 2024 | Belgique | Steve Cocriamont

Webinaire de mise à jour IPP – printemps 2024Webinaire | Jeudi 18 avril 2024 | Belgique | Steve Cocriamont -

Naviguer dans le paysage ESG : des conseils juridiques pour la réussite des entreprisesWebinaire | Vendredi 17 mai 2024 | Belgique | Virginie Frémat

Naviguer dans le paysage ESG : des conseils juridiques pour la réussite des entreprisesWebinaire | Vendredi 17 mai 2024 | Belgique | Virginie Frémat -

Formation hybride – Responsabilité des pouvoirs publics en matière fiscale : actualités et développementsFormation | Vendredi 26 avril 2024 | Belgique | Geoffroy Galéa, Alain Thilmany

Formation hybride – Responsabilité des pouvoirs publics en matière fiscale : actualités et développementsFormation | Vendredi 26 avril 2024 | Belgique | Geoffroy Galéa, Alain Thilmany -

Masterclass Planification patrimoniale 2024 – Jour 2Formation | Mardi 14 mai 2024 | Belgique | François Derème

Masterclass Planification patrimoniale 2024 – Jour 2Formation | Mardi 14 mai 2024 | Belgique | François Derème -

Masterclass Planification patrimoniale 2024 – Jour 3Formation | Mardi 21 mai 2024 | Belgique | François Derème

Masterclass Planification patrimoniale 2024 – Jour 3Formation | Mardi 21 mai 2024 | Belgique | François Derème -

Formation – Initiation à la Communication NonViolenteJour 2Formation | Mardi 11 juin 2024 | Belgique | Patrick Kileste, Jean-Yves Lagasse de Locht

Formation – Initiation à la Communication NonViolenteJour 2Formation | Mardi 11 juin 2024 | Belgique | Patrick Kileste, Jean-Yves Lagasse de Locht -

Formation – Initiation à la Communication NonViolenteJour 1Formation | Mardi 21 mai 2024 | Belgique | Patrick Kileste, Jean-Yves Lagasse de Locht

Formation – Initiation à la Communication NonViolenteJour 1Formation | Mardi 21 mai 2024 | Belgique | Patrick Kileste, Jean-Yves Lagasse de Locht -

Masterclass ISOC 2024 – Le financement des entreprisesJour 2 pmFormation | Vendredi 14 juin 2024 | Belgique | Matthieu Bataille, Laura Dewez, Fabrice Grognard, Lionel Lambert, Baudouin Paquot, Véronique Tai, Jérôme Terfve

Masterclass ISOC 2024 – Le financement des entreprisesJour 2 pmFormation | Vendredi 14 juin 2024 | Belgique | Matthieu Bataille, Laura Dewez, Fabrice Grognard, Lionel Lambert, Baudouin Paquot, Véronique Tai, Jérôme Terfve -

Masterclass ISOC 2024 – Les dispositions anti-abus à l'ISOCJour 2 amFormation | Vendredi 14 juin 2024 | Belgique | Matthieu Bataille, Laura Dewez, Fabrice Grognard, Lionel Lambert, Baudouin Paquot, Véronique Tai, Jérôme Terfve

Masterclass ISOC 2024 – Les dispositions anti-abus à l'ISOCJour 2 amFormation | Vendredi 14 juin 2024 | Belgique | Matthieu Bataille, Laura Dewez, Fabrice Grognard, Lionel Lambert, Baudouin Paquot, Véronique Tai, Jérôme Terfve -

Masterclass ISOC 2024 – Les opérations de clôture en fin d'exerciceJour 3Formation | Vendredi 11 octobre 2024 | Belgique | Matthieu Bataille, Laura Dewez, Fabrice Grognard, Lionel Lambert, Lionel Lambert de Rouvroit, Baudouin Paquot, Véronique Tai, Jérôme Terfve

Masterclass ISOC 2024 – Les opérations de clôture en fin d'exerciceJour 3Formation | Vendredi 11 octobre 2024 | Belgique | Matthieu Bataille, Laura Dewez, Fabrice Grognard, Lionel Lambert, Lionel Lambert de Rouvroit, Baudouin Paquot, Véronique Tai, Jérôme Terfve

Nos solutions digitales pour que vous puissiez gagner du temps pour vous et vos clients

-

Revue de droit commercial belge – Tijdschrift voor Belgisch HandelsrechtRevue | Abonnement 2024 - 10 numéros par an | Belgique

Revue de droit commercial belge – Tijdschrift voor Belgisch HandelsrechtRevue | Abonnement 2024 - 10 numéros par an | Belgique -

-

-

Mon Astuces & ConseilsDes conseils sur mesure pour votre profilBase de données | Abonnement 1 an | Belgique

Mon Astuces & ConseilsDes conseils sur mesure pour votre profilBase de données | Abonnement 1 an | Belgique -

TaxWin Praxis | AccountantsPour les professionnels de la comptabilité et de la fiscalitéBase de données | Abonnement 1 an | Belgique1 431,00 € TTC

TaxWin Praxis | AccountantsPour les professionnels de la comptabilité et de la fiscalitéBase de données | Abonnement 1 an | Belgique1 431,00 € TTC -

TaxWin Expert | SilverPour les fiscalistes et les expertsBase de données | Abonnement 1 an | Belgique2 501,60 € TTC

TaxWin Expert | SilverPour les fiscalistes et les expertsBase de données | Abonnement 1 an | Belgique2 501,60 € TTC -

TaxWin Expert | GoldPour les fiscalistes et les expertsBase de données | Abonnement 1 an | Belgique3 566,90 € TTC

TaxWin Expert | GoldPour les fiscalistes et les expertsBase de données | Abonnement 1 an | Belgique3 566,90 € TTC -

Les Codes Larcier – République démocratique du CongoVersion en ligne à jour en permanenceBase de données | Abonnement 1 an | Monde | Alex Kabinda Ngoy968,00 € TTC

Les Codes Larcier – République démocratique du CongoVersion en ligne à jour en permanenceBase de données | Abonnement 1 an | Monde | Alex Kabinda Ngoy968,00 € TTC -

PCA-VOB – Pour un calcul objectif des contributions alimentairesLogiciel de calculLogiciel | Abonnement 1 | Belgique | Roland Renard, Pierre-André Wustefeld357,00 € TTC

PCA-VOB – Pour un calcul objectif des contributions alimentairesLogiciel de calculLogiciel | Abonnement 1 | Belgique | Roland Renard, Pierre-André Wustefeld357,00 € TTC -

-

Nos solutions digitales pour que vous puissiez gagner du temps pour vous et vos clients

Easydrafting pour personnaliser facilement vos documents juridiques

Une façon rapide et intuitive de générer des documents juridiques sur mesure

Easydrafting vous fait gagner un temps précieux en vous permettant de constituer facilement des documents juridiques sur mesure.

Il vous suffit de choisir un modèle dans la bibliothèque et de le personnaliser en quelques clics. Notre questionnaire interactif vous guide étape par étape pour une rédaction automatisée de vos actes et contrats.

Vous avez également la possibilité d’ajouter vos propres modèles afin de les exploiter plus facilement.

Nouveau dans la collection Astuces et Conseils

-

Le livre de poche de l'indépendantAdapté aux nombreuses modifications législatives récentesLivre | 13e édition 2024 | Belgique | L'équipe rédactionnelle Astuces & Conseils82,00 € TTCEn stock expédié endéans les 2 jours ouvrables

Le livre de poche de l'indépendantAdapté aux nombreuses modifications législatives récentesLivre | 13e édition 2024 | Belgique | L'équipe rédactionnelle Astuces & Conseils82,00 € TTCEn stock expédié endéans les 2 jours ouvrables -

Mariage, cohabitation légale et cohabitation de faitQuelles sont pour l’indépendant que vous êtes les conséquences pratiques, fiscales et juridiques de votre choix ?Livre | 2e édition 2024 | Belgique | Martin Vanden Eynde165,00 € TTCEn stock expédié endéans les 2 jours ouvrables

Mariage, cohabitation légale et cohabitation de faitQuelles sont pour l’indépendant que vous êtes les conséquences pratiques, fiscales et juridiques de votre choix ?Livre | 2e édition 2024 | Belgique | Martin Vanden Eynde165,00 € TTCEn stock expédié endéans les 2 jours ouvrables -

Manuel pratique pour celui qui envisage un licenciement pour motif graveLivre | 2e édition 2024 | Belgique | Hervé Deckers135,00 € TTCEn stock expédié endéans les 2 jours ouvrables

Manuel pratique pour celui qui envisage un licenciement pour motif graveLivre | 2e édition 2024 | Belgique | Hervé Deckers135,00 € TTCEn stock expédié endéans les 2 jours ouvrables -

Comment licencier en toute sécurité moyennant un délai ou une indemnité de préavis ?Questions et réponses issues de la pratiqueLivre | 3e édition 2024 | Belgique | Hervé Deckers135,00 € TTCEn stock expédié endéans les 2 jours ouvrables

Comment licencier en toute sécurité moyennant un délai ou une indemnité de préavis ?Questions et réponses issues de la pratiqueLivre | 3e édition 2024 | Belgique | Hervé Deckers135,00 € TTCEn stock expédié endéans les 2 jours ouvrables -

Les règles actuelles relatives au bail commercial et aux autres baux professionnelsGuide pratique pour le bailleur et le locataireLivre | 8e édition 2024 | Belgique | L'équipe rédactionnelle Astuces & Conseils135,00 € TTCEn stock expédié endéans les 2 jours ouvrables

Les règles actuelles relatives au bail commercial et aux autres baux professionnelsGuide pratique pour le bailleur et le locataireLivre | 8e édition 2024 | Belgique | L'équipe rédactionnelle Astuces & Conseils135,00 € TTCEn stock expédié endéans les 2 jours ouvrables -

L'abc des frais déductibles de l'indépendant en nom personnelLa garantie de communiquer à votre comptable tous les postes de frais déductibles potentielsLivre | 16e édition 2024 | Belgique | Didier Crahay, Guy Ceresetti, Dominique Darte165,00 € TTCEn stock expédié endéans les 2 jours ouvrables

L'abc des frais déductibles de l'indépendant en nom personnelLa garantie de communiquer à votre comptable tous les postes de frais déductibles potentielsLivre | 16e édition 2024 | Belgique | Didier Crahay, Guy Ceresetti, Dominique Darte165,00 € TTCEn stock expédié endéans les 2 jours ouvrables -

Aperçu global de la législation sur le bail d'habitation dans les trois RégionsDes astuces & conseils pour agir en toute sécurité juridiqueLivre | 13e édition 2024 | Belgique | L'équipe rédactionnelle Astuces & Conseils135,00 € TTCEn stock expédié endéans les 2 jours ouvrables

Aperçu global de la législation sur le bail d'habitation dans les trois RégionsDes astuces & conseils pour agir en toute sécurité juridiqueLivre | 13e édition 2024 | Belgique | L'équipe rédactionnelle Astuces & Conseils135,00 € TTCEn stock expédié endéans les 2 jours ouvrables -

L'abc des frais déductibles de votre sociétéComment faire assumer un maximum de frais par votre société en 2024 ?Livre | 16e édition 2024 | Belgique | Guy Ceresetti, Didier Crahay, Dominique Darte165,00 € TTCEn stock expédié endéans les 2 jours ouvrables

L'abc des frais déductibles de votre sociétéComment faire assumer un maximum de frais par votre société en 2024 ?Livre | 16e édition 2024 | Belgique | Guy Ceresetti, Didier Crahay, Dominique Darte165,00 € TTCEn stock expédié endéans les 2 jours ouvrables -

Investir les liquidités accumulées par votre société : via votre société ou à titre privé ?Livre | 4e édition 2024 | Belgique | David De Backer135,00 € TTCEn stock expédié endéans les 2 jours ouvrables

Investir les liquidités accumulées par votre société : via votre société ou à titre privé ?Livre | 4e édition 2024 | Belgique | David De Backer135,00 € TTCEn stock expédié endéans les 2 jours ouvrables -

Cesser votre activité indépendante anticipativement, à la date de votre pension ou continuer ?Quelles en sont les conséquences sur le plan fiscal, social et financier ?Livre | 9e édition 2024 | Belgique | Wim De Buyser, Jos Coomans135,00 € TTCEn stock expédié endéans les 2 jours ouvrables

Cesser votre activité indépendante anticipativement, à la date de votre pension ou continuer ?Quelles en sont les conséquences sur le plan fiscal, social et financier ?Livre | 9e édition 2024 | Belgique | Wim De Buyser, Jos Coomans135,00 € TTCEn stock expédié endéans les 2 jours ouvrables -

Comment retirer de votre société une rémunération optimale sur le plan fiscal ?Calculer et retirer votre rémunération sans payer trop d’impôtsLivre | 10e édition 2024 | Belgique | Hervé Deckers135,00 € TTCEn stock expédié endéans les 2 jours ouvrables

Comment retirer de votre société une rémunération optimale sur le plan fiscal ?Calculer et retirer votre rémunération sans payer trop d’impôtsLivre | 10e édition 2024 | Belgique | Hervé Deckers135,00 € TTCEn stock expédié endéans les 2 jours ouvrables -

L’impact de la réforme TVA à partir du 1er janvier 2025 : comment l’appréhender ?L’impact de la réforme sur vos déclarations et paiements/crédits TVALivre | 2e édition 2024 | Belgique | Sandrina Procek165,00 € TTCEn stock expédié endéans les 2 jours ouvrables

L’impact de la réforme TVA à partir du 1er janvier 2025 : comment l’appréhender ?L’impact de la réforme sur vos déclarations et paiements/crédits TVALivre | 2e édition 2024 | Belgique | Sandrina Procek165,00 € TTCEn stock expédié endéans les 2 jours ouvrables -

Le grand guide des impôtsToute l'information fiscale essentielle pour les dirigeants d'entreprise, les indépendants, les professions libérales et leurs conseillersLivre | 8e édition 2024 | Belgique | Florence Goffinet215,00 € TTCEn stock expédié endéans les 2 jours ouvrables

Le grand guide des impôtsToute l'information fiscale essentielle pour les dirigeants d'entreprise, les indépendants, les professions libérales et leurs conseillersLivre | 8e édition 2024 | Belgique | Florence Goffinet215,00 € TTCEn stock expédié endéans les 2 jours ouvrables -

20 techniques pour réaliser une donation sans payer de droits de donationCe que vous devez savoir au préalable !Livre | 1ère édition 2024 | Belgique | Thomas Roelands, Olivier Doms, Minne Corentin165,00 € TTCEn stock expédié endéans les 2 jours ouvrables

20 techniques pour réaliser une donation sans payer de droits de donationCe que vous devez savoir au préalable !Livre | 1ère édition 2024 | Belgique | Thomas Roelands, Olivier Doms, Minne Corentin165,00 € TTCEn stock expédié endéans les 2 jours ouvrables

Nos articles et contenus gratuits pour décrypter l'actualité

Livre blanc

Fiscal | Octobre 2023

La loi anti-blanchiment actuelle est-elle pour vous un terrain inconnu ? Ce livre blanc vous aide dans cette démarche et résume tout ce que vous devez savoir sur la loi anti-blanchiment.

Téléchargez-le.

Notre dernière interview

Droit judiciaire | Octobre 2023

Mediation Week 2023 | Journal des modes alternatifs

La "Mediation Week" s'est tenue cette année, du 9 au 14 octobre 2023. Chaque jour de la semaine, des contributeurs du Journal des modes alternatifs ont abordé un sujet lié à la médiation, offrant ainsi une perspective diversifiée sur cette pratique. En savoir plus ici.

Le podcast de la JLMB

Droits de l'homme | Novembre 2023

N° 2023/38 – L'accueil des migrants : la fin de l'état de droit ? | Patrick Henry

Dans cet épisode du podcast de la revue de Jurisprudence de Liège, Mons et Bruxelles, l'avocat Patrick Henry aborde le sujet suivant : l'accueil des migrants : la fin de l'état de droit ?

En savoir plus ici.

1500 auteurs spécialisés et renommés à votre service

Partenaires de paiement reconnus